Introduction

Are you considering expanding your business horizons by establishing a company in Europe?

With its diverse markets, robust infrastructure, and strategic global position, Europe offers many opportunities for entrepreneurs. However, navigating the complexities of European business regulations can be daunting. It has a vast customer base, a supportive business environment, and access to world-class talent, the European continent presents countless opportunities for entrepreneurs and investors alike.

But where do you even begin? What are the legal, financial, and regulatory steps involved? How do you choose the best country for your business? These are common concerns for anyone considering expansion into Europe.

This comprehensive guide will walk you through each step of the process, ensuring you’re well-equipped to launch your European venture successfully.

Why Europe for Business?

The question is what makes Europe so attractive to business owners?

- Access to a Vast Market: The European Union (EU) comprises 27 member countries, providing seamless access to a market of over 447 million consumers.

- Economic Stability: Many European nations boast strong economies, offering a stable environment for business operations.

- Skilled Workforce: Europe’s emphasis on education and innovation ensures a pool of highly skilled professionals across various sectors.

- Supportive Business Environment: Numerous countries offer incentives, grants, and favorable tax regimes to attract foreign investment.

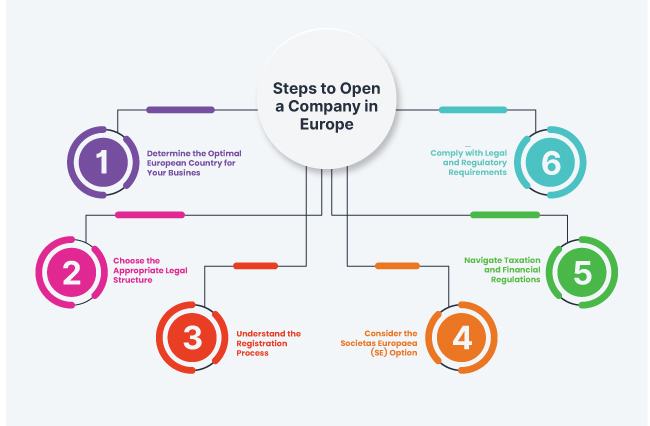

Steps to Opening a Company in Europe

Europe is home to approximately 33 million enterprises, employing over 163 million individuals, and generating a net turnover exceeding €38 trillion. Notably, small and medium-sized en

terprises (SMEs) constitute 99% of these businesses, underscoring the continent’s vibrant entrepreneurial landscape.

Step 1: Determine the Optimal European Country for Your Business

Choosing the right country is crucial. Factors to consider include:

- Taxation Policies: Corporate tax rates vary across Europe. For instance, Ireland offers a competitive rate of 12.5%, while Hungary boasts one of the lowest at 9%.

- Legal Framework: Some countries have streamlined company formation procedures. Estonia, for example, offers fully digital incorporation processes, making it easier for entrepreneurs to set up businesses remotely.

- Economic Stability: Assess the country’s economic health, growth prospects, and political stability.

- Industry Support: Certain nations provide robust support for specific industries through grants, subsidies, or favorable regulations.

- Residency and Immigration: Understand the residency permit requirements, especially if you plan to relocate or hire foreign talent.

Step 2: Choose the Appropriate Legal Structure

The legal structure of your company will influence taxation, liability, and regulatory obligations. Common structures include:

- Private Limited Company: Known as “Ltd.” in the UK or “GmbH” in Germany, this structure limits shareholders’ liability to their investment.

- Public Limited Company: Suitable for larger businesses aiming to raise capital publicly.

- Societas Europaea (SE): A European public limited-liability company that allows you to operate across EU countries under a unified legal framework. Establishing an SE requires a minimum subscribed capital of €120,000.

Step 3: Understand the Registration Process

While procedures vary by country, general steps include:

- Company Name Registration: Ensure your desired company name is unique and complies with local regulations.

- Prepare Documentation: This typically involves drafting the company’s articles of association and other foundational documents.

- Deposit Share Capital: Some countries require a minimum share capital to be deposited in a corporate bank account.

- Register with Authorities: Submit necessary documents to the national business registry. For example, in Poland, the registration process involves applying to the National Court Register (KRS).

- Obtain Tax Identification Numbers: Register for corporate tax, Value Added Tax (VAT), and other relevant taxes.

- Comply with Employment Regulations: If hiring staff, ensure adherence to local labor laws, including contracts, benefits, and working conditions.

Step 4: Consider the Societas Europaea (SE) Option

If you plan to operate in multiple EU countries, forming a Societas Europaea can be advantageous. Benefits include:

- Simplified Cross-Border Operations: Operate under a single legal entity across multiple countries.

- Flexibility in Relocating Registered Office: Transfer your registered office to another EU country without dissolving the company.

- Employee Participation Framework: Establish a standardized system for involving employees in company decisions across different countries.

To set up an SE, your company must have a presence in at least two EU countries and meet specific capital requirements.

Step 5: Navigate Taxation and Financial Regulations

Understanding the tax landscape is essential:

- Corporate Tax Rates: These vary by country. For instance, Ireland offers a 12.5% rate, while Germany’s rate is approximately 30%.

- Value Added Tax (VAT): Standard VAT rates typically range from 17% to 27%. Registering for VAT and regular filings are mandatory.

- Tax Incentives: Many countries offer incentives for research and development, innovation, or investment in certain regions.

Engaging with local tax professionals can help optimize your tax strategy and ensure compliance.

Step 6: Comply with Legal and Regulatory Requirements

Adherence to local laws is paramount:

- Corporate Governance: Follow rules regarding company management and reporting.

- Data Protection: Ensure compliance with the General Data Protection Regulation (GDPR) for handling personal data.

- Environmental Regulations: Meet standards for sustainability and environmental impact, especially if your business involves manufacturing or resource use.

- Anti-Money Laundering (AML): Implement measures to prevent financial crimes, including thorough customer verification processes.

The Challenges of Expanding to Europe

Despite its many benefits, expanding into Europe isn’t without challenges. Each country has its own corporate laws, tax systems, and residency requirements. Navigating these can be complex, especially for foreign entrepreneurs unfamiliar with local regulations.

- Which country should you choose?

Some have lower tax rates, while others offer stronger investor protection.

- How do you handle legal requirements?

Business registration, tax filings, and labor laws differ widely between nations.

- What are the costs?

From minimum share capital requirements to ongoing compliance fees, the costs of setting up a company in Europe can vary significantly.

A Continent of Opportunity

Europe isn’t just one market, it’s a collection of diverse economies, each with its advantages. In case you’re looking to tap into Germany’s industrial strength, Ireland’s tech ecosystem, or Estonia’s digital-first approach, you’ll find a business environment suited to your needs.

- A Massive Consumer Market: The European Union (EU) alone has over 447 million consumers, making it one of the largest and most lucrative markets in the world.

- Business-Friendly Policies: Many European countries provide tax benefits, funding programs, and simplified company registration processes to encourage entrepreneurship.

- Political and Economic Stability: The EU, along with non-EU countries like Switzerland and Norway, offers a secure and transparent business environment compared to many other global markets.

- World-Class Infrastructure – From seamless digital services to efficient transport networks, Europe is designed to support businesses of all sizes.

Your European Business Journey Starts Now

Expanding your business to Europe or launching a new venture on the continent can be one of the most rewarding decisions you make. With access to a vast consumer base, a stable economic environment, and a wealth of government incentives, Europe presents endless opportunities for entrepreneurs. However, success in this market depends on careful planning, informed decision-making, and compliance with legal and financial regulations.

So, what’s next? It’s time to take action. Research your preferred country, gather the necessary documentation, and start laying the foundation for your European business venture.