Are you considering starting a business in Portugal? Well, you’re in good Company! Learn how to set up your own Company in Portugal, a top choice for global investors, thanks to its strategic location, favorable taxation, and growing economy.

Portugal has become a top choice for global investors, and for a good reason. The country’s government actively supports businesses focused on innovation, and with a vast pool of highly skilled workers, you’ll find the talent you need.

Portugal’s strategic location, favorable tax environment, and thriving GDP make it an enticing destination for entrepreneurs seeking to set up a company abroad. The Portuguese government offers public financial assistance, further adding to the appeal of starting a business in this beautiful and dynamic country.

Establishing a business here is quick and straightforward, regardless of the type of Company you want to open. In this guide, we’ll walk you through the steps and requirements to set up a company in Portugal, making it an easy and hassle-free experience.

Let’s get started on your entrepreneurial journey in Portugal!

Can Foreigners Start A Business In Portugal?

Yes, foreigners can start a business in Portugal. To do so, they must have their Portuguese residency card, obtain a tax number (NIF) from the Portuguese tax office, and acquire a social security number. For non-EU/EFTA nationals, starting a business requires obtaining a Portuguese visa and residency permit.

On the other hand, foreign companies can establish a branch or subsidiary of their Company in Portugal by registering it with the Portuguese Registries and Notaries (IRN) and the Commercial Registry Office.

What Is The Regulatory Environment In Portugal Like?

Portugal has a long history of international trade has shaped its current liberal economic approach. The regulatory environment is business-friendly, adhering to standard EU rules. Foreign companies are allowed to invest freely, although there are some restrictions in specific strategic sectors. There are no barriers to capital entering the country, and companies can repatriate profits or dividends without any constraints.

Steps To Set Up Your Company

Choose Legal Structure for Your Business

The first step before starting a business in Portugal is selecting the best legal structure for you. Here is a list of existing business structures in Portugal:

| Company Type | Description |

| Individual Entrepreneur (Empresário em Nome Individual) | An entrepreneur can provide services or products without requiring a minimum capital. However, personal and business assets are not separated, leading to unlimited liability. One can claim social security fees tax exemption from in first year. |

| Individual Limited Liability Establishment (Estabelecimento Individual de Responsabilidade Limitada) | This type requires a minimum share capital of €5,000 and ensures a distinction between personal and your business assets. |

| Sole Proprietorship (Sociedade Unipessoal por Quotas) | Owned by a single person, this structure allows you to set your capital with an investment of €1 (€2 for two partners). Creating your own bank account and hiring an accountant is also necessary. |

| General Partnership (Sociedade em Nome Coletivo) | There are no specific minimum share capital requirements for a general partnership. Each partner holds unlimited liability for the Company’s social obligations. |

| Limited Partnership (Sociedade em Comandita) | This legal structure requires a minimum investment of €50,000. It consists of two types of partners: Those with unlimited liability who manage the Company, And others with limited liability. |

| Private Limited Company (Sociedade por Quotas) | It needs a minimum of two partners and an investment of €5,000 |

| Public Limited Company (Sociedade Anónima) | A public limited company should have at least five partners, each owning company stock. A minimum capital of €50,000 is necessary to apply for this type of Company. |

Choose Company Name

When selecting the Company’s name, the shareholders have pre-approved company names from the Portuguese Registry of Business Names. These names already have a unique entity number, a taxpayer number (NIPC), along with a Social Security number, which will be given after the Company is incorporated. However, the final decision on the name is made during the incorporation process in person.

Suppose the shareholders wish to use a name which is not on the pre-approved list. In that case, they can present a name approval certificate obtained beforehand from the National Registry of Legal Entities.

Set Up Your Company

To establish your Company, first, make sure you have a chosen name and selected the appropriate business model. Now, you can proceed with the company set up by signing the deed of incorporation. There are three primary methods to set up a company in Portugal, two of which are online options, and the other follows a traditional approach:

| Method | Description |

| Online Setup (Empresa Online) | This method allows for quick company formation in Portugal and typically takes one to two days. Electronic certification is necessary. |

| On-the-Spot Setup (Empresa de Hora) | This option is commonly used for sole traders and limited companies. The setup is done in person through a government scheme. The Company’s principals must be present and provide all required documentation. |

| Traditional Method | Setting up a company involves obtaining a Certificate of Admissibility from the Institute of Registries and Notaries (IRN). This certificate formally identifies the new Company. The primary business identity is established through a Company Card and a Collective Card, both issued by the IRN. |

Draft the Articles of Association

The first step in setting up a company in Portugal is to draft the Articles of Association. This legal document outlines vital details about the Company, such as its name, owners, business activities, share capital, and internal organization. You may need assistance from a lawyer or a legal professional to ensure the document meets all the requirements.

In the Articles of Association, you should clearly state the names and addresses of the Company’s owners (shareholders) and their respective stakes. Additionally, it must specify the Company’s objectives and business activities. This document will be crucial for the Company’s registration process and should be well-prepared to avoid delays.

Sign the Articles of Association

When you choose the articles of association, they should be signed immediately, and the commercial registration will follow suit. Shareholders will then obtain an access code granting them access to the online registry certificate, your Company’s social security number, along with a certificate of the articles of association.

In addition, the Company will issue an electronic company card, which serves as the Company’s ID card. The card will include the Company’s Legal Entity Identification Number (NIPC), which is also its taxpayer and social security numbers.

Open a Bank Account to Deposit

Once the Articles of Association are ready, the next step is to open a bank account in Portugal for the Company. The law requires a minimum share capital of EUR 5,000 for a (Private Limited Company), which must be deposited in the Company’s bank account. This initial capital will fund the Company’s operations and can be withdrawn after the registration process.

Choose a reputable bank in Portugal that suits your business needs and has experience dealing with company setups. The bank will provide the necessary documentation and guide you through the account opening process. Your accountant will use your IBAN information to register your Company’s activity with the tax office, ensuring you are prepared to pay taxes.

Apply for Licenses and Permits

The licensing and permit requirements for a company in Portugal depend on the nature of its activities. Specific business sectors like finance, healthcare, and construction may have specific licensing regulations. Before commencing any business operations, it’s essential to determine the licenses and permits required for your Company.

You must gather relevant documentation and apply to the Directorate-General for Economic Activities (DGAE) to apply for licenses and permits. Engage with legal advisors or business consultants who can help navigate the process efficiently and ensure compliance with all regulations.

Submit activity statement

A commencement of activity statement must be filed for tax registration purposes. If signed by a Certified Accountant (Técnico Oficial de Contas) (TOC), this declaration can be provided directly to the Company on the Spot service. If not, the statement must be lodged with the tax authorities within 15 days of the Company’s establishment.

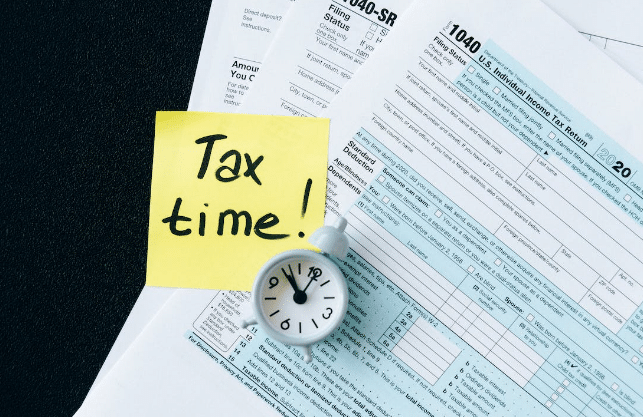

Register for Tax Purposes and Social Contributions

Tax registration is fundamental in establishing your Company’s legal presence in Portugal. You must register your Company with the Portuguese Tax Authority and obtain a taxpayer identification number (NIF). This number will be used for all tax-related transactions and reporting.

Additionally, as an employer, you are required to register your Company and its employees with the Portuguese Social Security system. This registration ensures that your Company complies with social contribution requirements and offers social security benefits to your employees.

To register for tax purposes and social contributions, you must submit specific forms and documentation to the relevant authorities. Again, professional guidance can be beneficial to ensure accurate and timely registration.

Submit Beneficial Owner Statement

Within 30 days of incorporation, the Company must determine its ultimate beneficial owners by filing a declaration on the Central Registry of Ultimate Beneficial Owners using its digital platform.