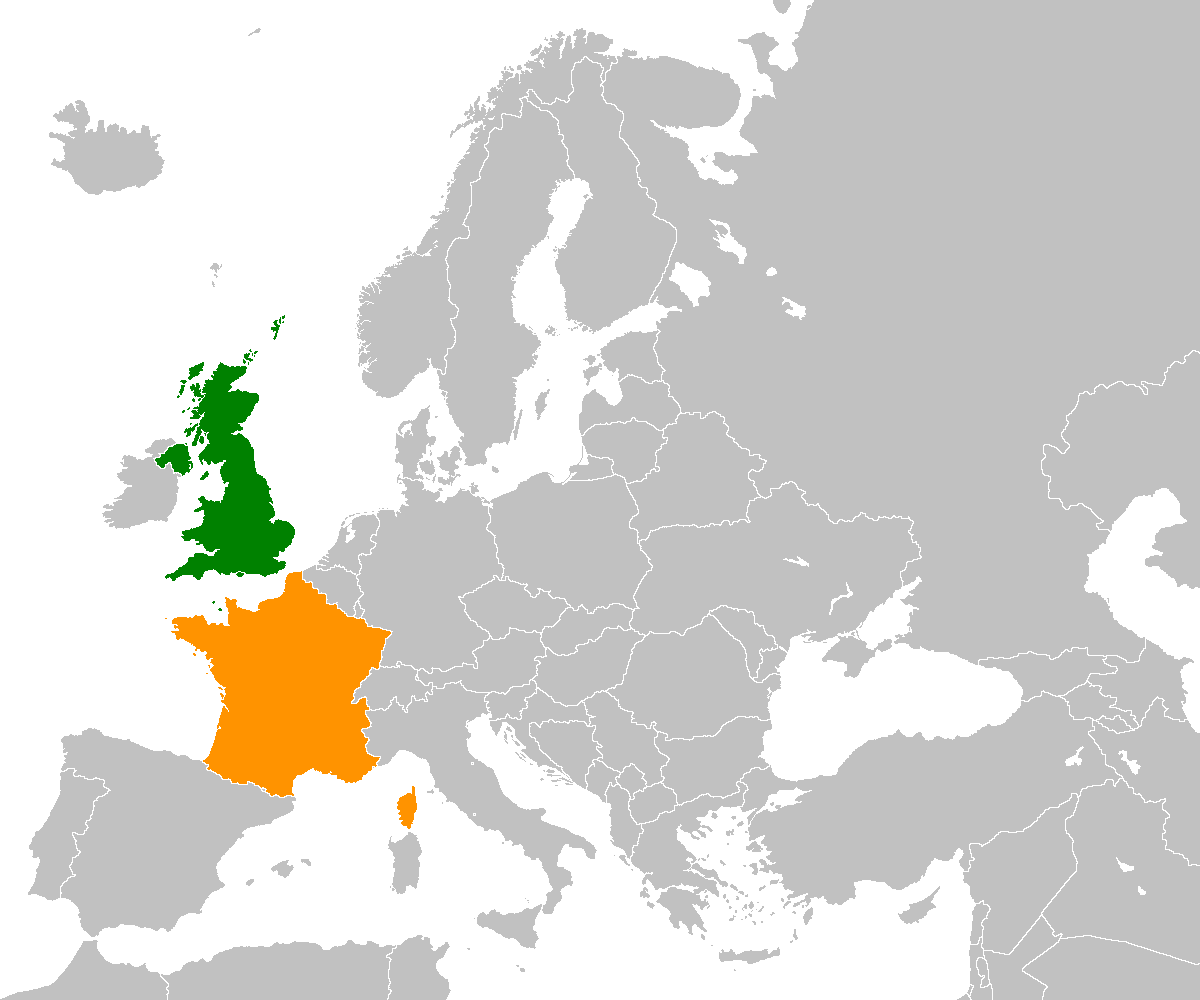

If you are looking to establish a presence within the EU after Brexit – you may wish to consider setting up a branch or subsidiary in France. France has its pros and cons but it is one of the quickest countries to set up a branch in.

The quickest way to establish a presence within the EU

The process can take maximum 10 days including the VAT and EORI registrations. This will probably be highly useful for businesses that need to trade within Europe and have not made provision post Brexit.

To open a branch of a foreign company in France, you will need help from a company formation agent who can sort out all the paperwork for you.

The first thing they’ll do is sort out a registered office or premises in Paris (or any other French region you wish to do business in) and register the branch with the Trade Registry. They will help you to collate various documents which will need to be translated by a certified French translator. These include:

- Memorandum and Articles of Association of the parent company.

- copies of the Certificate of Incorporation

- application to register a branch

Open a French Branch

The French branch name will be the same as the Mother company’s name. You can always add a commercial name that will be the name used for your marketing and Invoicing.

Small to Medium-sized businesses looking to have a foothold or sell into Europe may consider this option as it is fast, convenient and cost-effective.

Open a French Subsidiary

Alternatively, businesses may look at setting up a French subsidiary of the UK company that will allow them a degree of protection as there is limited liability within the French company, Branches, on the other hand, devolve back to the mother company for their liability.

Differences between the French branch and the French subsidiary

Other differences between the French branch and the French subsidiary are that the subsidiary will need a French bank account to deposit share capital while the branch can use an online payment solution of some type in the name of the branch.

Both may need special licences or trading permissions dependent upon the type of work undertaken within the company. Both will also be registered for VAT and the possibility of an EORI number.

Establish a presence within the EU in other countries

There are other options to set up a branch or subsidiary in the EU after Brexit including Germany, The Netherlands, Italy, Spain and Portugal.

Thinking about setting up in any of these countries will entail a little bit of decision making as to which country would be the best option for the establishment of your business whether this is recruitment, e-commerce, retail or food sales.

Questions you may want to consider are:

- How big is the market for my product or service in each country?

- Do I need permits to operate in the country I would like to establish?

- What are my ongoing costs for setting up the business and will this be cost-effective for me to set up in one specific country as opposed to another based upon the amount of income generated?

Contact us for help and advise

Please don’t hesitate to call us on +44 (0) 20 8421 7470 or contact us via the website for help and advice about the quickest way to establish a presence within the EU after Brexit.