Where some see only gloom, others spot an opportunity. The portents following Brexit haven’t been kind for many industries, or indeed the rest of Europe, where the prevailing sentiment is that the UK should be made an example of to dissuade other potential leavers. But for areas already under-served by the UK, leaving the EU could have unintended benefits. While non-EU countries seek to ramp up trade and investment, a few British businesses might be looking to launch new R&D operations abroad to take advantage of rapidly growing global hubs.

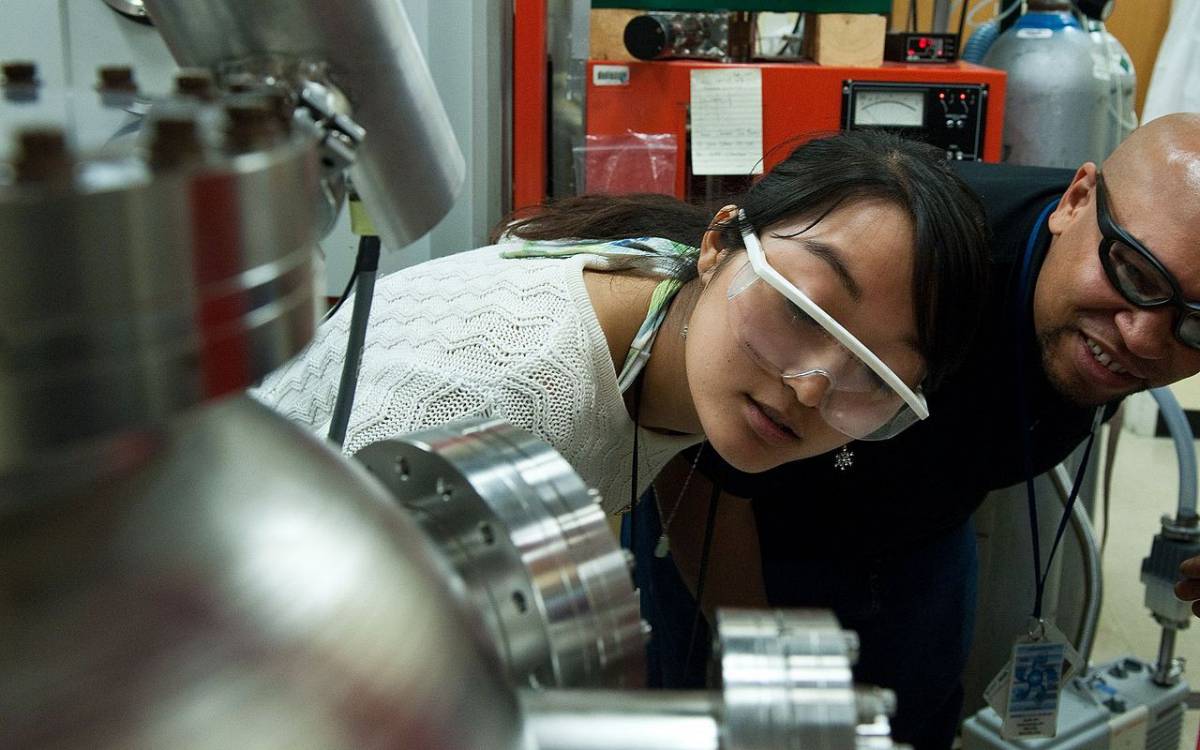

Scientists and researchers were among the first and loudest to call for Britain to stay in the EU, citing enormous European grants, the freedom of movement for skilled researchers and the necessity for co-operation with institutions across the continent. While none of those things have been tangibly affected in the wake of the vote, the uncertainty of the situation is making some researchers nervous.

Guarantees have only been made for EU citizens who were living in the country before the vote, and even those are tenuous. European institutions are reputedly declining to undertake new projects with British universities, and the weak Pound means that foreign investments, which constituted 18% of all R&D funding in 2014, aren’t worth as much.

While the new UK Business Secretary has promised to double tax relief for R&D as a means to cover the shortfall, it would take a big shift in approach to regain industry confidence. Although the country’s R&D presence is still significant, the percentage of GDP spent on R&D nosedived after 1990 and has scarcely recovered since: EU targets for 2014 were missed by 0.36%, and there’s little sign of reaching the touted 3% by 2020. While most businesses have significant vested interests in remaining in the UK, other locales may be more fruitful for new R&D projects.

Golden Relationship

One potential destination is China. Although the country has the 2nd highest number of professionals working in R&D, the percentage of its total workforce is among the lowest of any OECD country. This brain drain is impacting its ability to reinforce a strong manufacturing sector with original concepts, and arguably holding back science and tech companies like Huawei from reaching Apple’s level of world-conquering prowess. This isn’t great news for those looking to source talent locally, but for a business willing to relocate its staff, the world’s largest market could be a profitable staging post.

China certainly hasn’t been shy in courting and retaining talent. One example of this approach is the government’s attempts to lure back its own nationals. As of 2012 some 200,000 people were working outside of China having left to study, including 67,000 under the age of 45 and at or above the level of associate professor.

The US remains the largest spender on R&D in the world, and has looked to hire significant numbers of its Chinese students. But with the difficulties in getting a visa only set to escalate, China is making a concerted bid to win them back. Translated government policies indicate that those with a master’s degree, three years of experience and an initial funding pot will be rewarded with a free office lease for three years, funding of $160k-500k and three years’ exemption on capital gains tax.

The message seems to be getting through: between 2005 and 2012 the number of Chinese PhD graduates intending to stay in the US fell by 7%. This developmental approach also extends to bringing foreign professors and students into Chinese universities. The Thousand Talents Program (professors and researchers) and the Thousand Youth Talents Program (young professionals) were established following the global financial crash, with the aim of bolstering Chinese R&D. With these programs lapsing last year, it could be time to target investment.

Asian Innovation

China is far from the only country looking to lure businesses and talent to R&D. Japan and South Korea, both traditional manufacturing bases, are near the top of the global charts for R&D spending. Korea is a particularly exciting region, with government desires for a Nobel prize apparently driving the world’s highest level of R&D investment in 2014.

Manufacturing giants like Samsung, LG, Hyundai and a multitude of shipbuilding companies have propelled R&D growth at an average of 10.9% over the last ten years, and South Korea files more patents than any other country. Although both have issues with immigration and bureaucracy, the well-documented inefficiency of corporate culture could be a boon to foreign businesses. Offering roles and promotions based on talent rather than experience and playing on the cachet of their outsider status could help UK businesses to gain a significant foothold.

R&D opportunities across Asia

- Korea – 1st in % of GDP spent on research

- Israel – 2nd in % of GDP and a popular destination for world’s tech giants

- Taiwan and Singapore – 7th and 17th respectively in % of GDP spent

- India – most popular destination for ER&D

- China – 2nd highest in total spending & R&D workforce

Elsewhere on the continent, India is channelling its growing industrial clout into a burgeoning R&D sector. The world’s second most populous country is now the premier destination for engineering research and development (ER&D) centres, leading the way in the building of electronic machinery and automobiles. With the size of the local market, it’s feasible that the UK’s car companies could follow in the footsteps of GM, Honda, Mercedes and Renault-Nissan in setting up new R&D arms. Indeed BMW already have operations in the country, whose own companies Tata and Hero are driving a flourishing pool of talent to draw from.

For the tech industry, Israel is already renowned as the world’s R&D capital. Currently ranking second in percentage of GDP spent on R&D, the small nation already boasts an R&D presence from almost every major tech company in the world, including Apple, Microsoft, Google, IBM and Intel. The availability of STEM talent is unrivalled: 140 in every 10,000 employees is a scientist, technician or engineer.

As a region, Israel is second in the number of entrepreneurs to Silicon Valley, and boasts a famously productive defence-related R&D industry, with a positive influence on science, tech and the research community at large. Low salaries and a preponderance of exciting startups and individual talent makes acquisitions and expansion to Israel extremely tempting, even without the problems posed by Brexit.

With the UK government clearly acknowledging the need to protect its R&D industry, British researchers may not have too much to fear. But businesses like uncertainty as little as markets do, and the lack of preparation from politicians has not engendered confidence. With Asia’s R&D capitals also finding themselves in stronger economic standing than much of the rest of the world, Brexit could be an irresistible opportunity for businesses and workers to forge new projects and links abroad, and reap the rewards of greater investment.